Central Board of Indirect Taxes & Customs (CBIC) has issued a Press Release dated 11th June, 2019 to provide details regarding transition plan to implement the New GST Return System.

The Key Points of the Press Release are:

- New GST return system comprises of three components – one main return i.e. FORM GST RET -1 and two annexures i.e. FORM GST ANX-1 (details of outward supplies) and FORM GST ANX-2 (details of inward supplies) which will be introduced from July,2019 on trial basis, where the users would be able to upload invoices using FORM GST ANX -1 and also view and download inward supply of invoices using FORM GST ANX -2 offline tool.

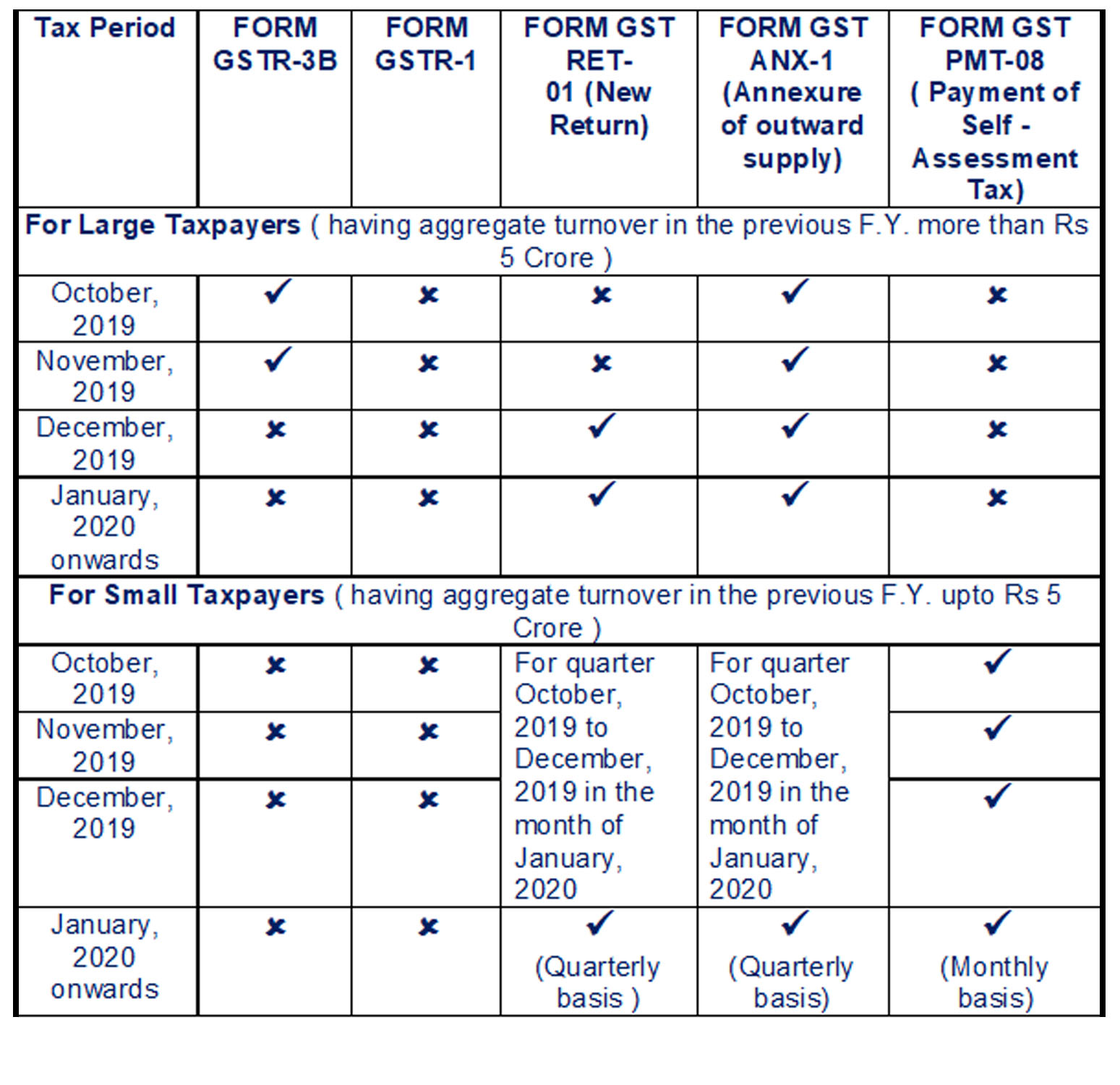

- For the tax periods from July, 2019 to September, 2019 , the tax payers shall continue to file the details of their outward supply in FORM GSTR-1 on monthly /quarterly basis and FORM GSTR-3B on monthly basis.

- From October, 2019 onwards, FORM GSTR -1 will be replaced by FORM GST ANX -1. Henceforth, the Large tax payers (whose aggregate annual turnover in the previous financial year was more than Rs. 5 Crore) would upload FORM GST ANX -1 on monthly basis and Small tax payers (with aggregate annual turnover in the previous financial year upto Rs. 5 Crore) would upload the FORM GST ANX -1 on quarterly basis for the months of October to December, 2019 on January,2020.

- For October and November 2019, large taxpayers would continue to file FORM GSTR-3B on monthly basis and for the month of December, 2019 they will file their first FORM GST RET -01 by 20th January, 2020. Small tax payers would stop filing GSTR -3B and would start filing FORM GST PMT- 08 from October, 2019 onwards.

- From January, 2020 onwards, all taxpayers shall be filing FORM GST RET-01 and FORM GSTR-3B shall be completely phased out.

- Separate instructions shall be issued for filing and processing of refund applications between October to December, 2019.

Given below is a tabular representation of the returns to be filed during the transition period (from the month of October, 2019 to December, 2019) –

Source: Central Board of Indirect Taxes & Customs (CBIC)